Do I Need a Lawyer for Debt Collection?

Whether you've already decided to send a customer to collections or are simply exploring options to recover unpaid invoices, begin with a financial data analysis. Start by answering the following questions:

- How many outstanding invoices do you have?

- How old are they?

- How many times have you reached out to your debtors?

- Have you already sent demand letters?

- How effective is your in-house debt recovery? For example, what percentage of outstanding debts does your business successfully collect?

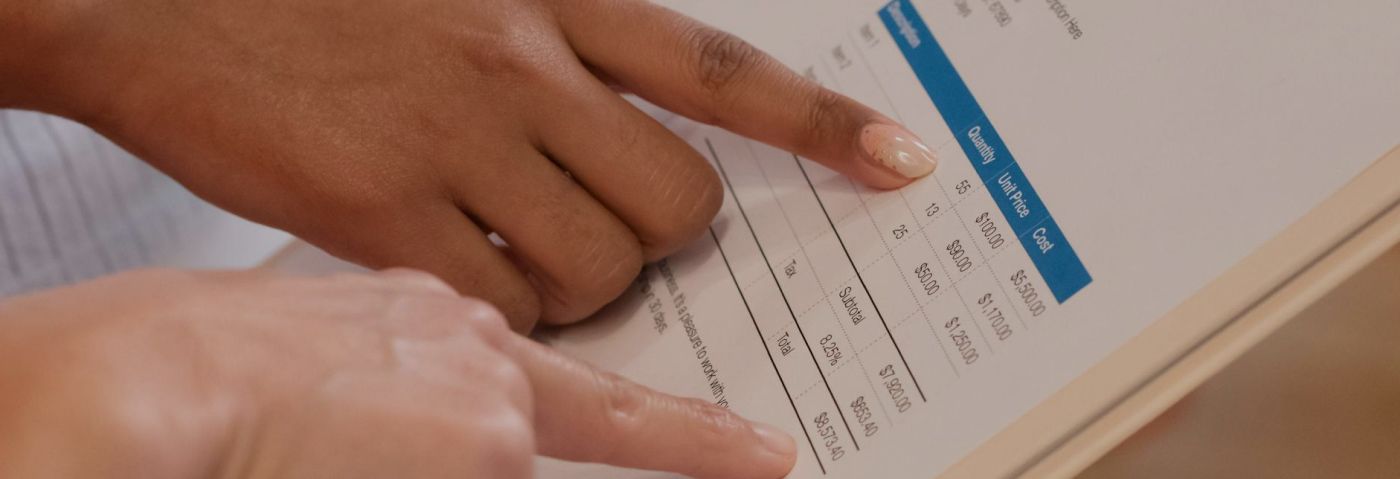

One of the most efficient methods to answer these questions is using an accounts receivable aging report, which indicates how long invoices have been outstanding.

Once the situation is clear, consider hiring a debt collection agency or a debt attorney at reasonable fees.

Debt Collection Attorney Fees

Collection attorneys usually charge a percentage of what is collected rather than offering a fixed fee. This means you don’t have to pay if the debt recovery is unsuccessful. The average collection attorney fee is 20-30% of the total debt. The fee also depends on the amount of debt: the higher the total debt value, the lower the percentage fee.

Some debt collection law firms charge an hourly rate, typically between $100 and $300 per hour. An hourly rate may be a better option when there is a high chance of collecting the debt.

Debt Collection Agency Fees

The fees charged by debt collection agencies for their services typically fall within a range of 20% to 50% of the funds they manage to recover. Furthermore, some agencies may stipulate the payment of a retainer as part of their contractual obligations related to contingency collections.

Various factors can influence the fees. One key factor is the age of the debt, with older debts often being more challenging to recover, which can increase the associated fees. Additionally, the account balance size matters; smaller balances often result in higher fees because of reduced profit margins for the collection agency.

The quantity of accounts can impact fee negotiations, as a higher number of accounts may facilitate the possibility of reduced fees. Moreover, the specific industry related to the debt can impact fees, as the characteristics and recovery success in different sectors vary. Understanding these factors helps manage expectations regarding collection agency costs.

How Much Does It Cost To Send Someone To Collections?

In the previous sections, we explored the commissions that debt collectors charge. Now, let's examine a specific example of how much it costs to send someone to collections.

Consider a scenario where a construction firm is owed $40,000 and hires a debt collection agency that charges a 20% contingency fee. If the debt is successfully recovered, the construction company would receive $32,000, while the debt collector retains $8,000 as their commission. If the agency fails to collect the debt, the construction company owes nothing to the collection agency.

What is a Debt Settlement Attorney?

A debt settlement attorney specializes in negotiating with creditors to reduce the amount of debt owed, helping individuals or businesses settle their financial obligations for less than the full balance. They work on behalf of clients to create manageable payment plans, often preventing lawsuits or other legal actions. By leveraging their legal expertise, these attorneys provide clients relief from overwhelming debt while protecting their rights throughout the settlement process.

Debt Settlement Lawyer Cost and Fees

Dealing with a debt lawsuit can be an overwhelming experience filled with anxiety. While hiring a debt attorney can provide significant support, it is essential to be informed about the financial implications of engaging a debt settlement lawyer before making a decision. Understanding the fee arrangements beforehand will help you gain clarity on your potential expenses.

Various payment models are commonly used in debt settlement cases. One option is an hourly rate, where you pay for the attorney's time as they work on your case. Alternatively, some lawyers may charge a percentage of the total debt, which typically ranges from 15% to 25%, or they might base their fees on the amount of savings you achieve through the settlement process.

Being aware of these different payment structures is vital for effective financial planning. By knowing how your attorney will charge you, you can make a more informed choice about whether to proceed with their services.

Conclusion

Whether you're looking for a debt settlement lawyer or debt recovery services, it's clear you're in a difficult situation. Attorney fees vary, and each debt collection case is unique, so it’s important to run calculations before hiring anyone. Understanding the fee structure is crucial to making an informed decision and avoiding additional financial strain.

Some attorneys charge a flat fee, while others work on a contingency basis, meaning they only get paid if they successfully reduce or recover your debt. Having a clear discussion about attorney fees and potential legal costs upfront will help you stay in control and avoid any surprises down the line.