For businesses, timely payments are the lifeblood of financial stability, yet unpaid invoices remain a persistent challenge. Debt collection services offer a professional solution, enabling companies to recover funds from past due accounts without straining resources or relationships.

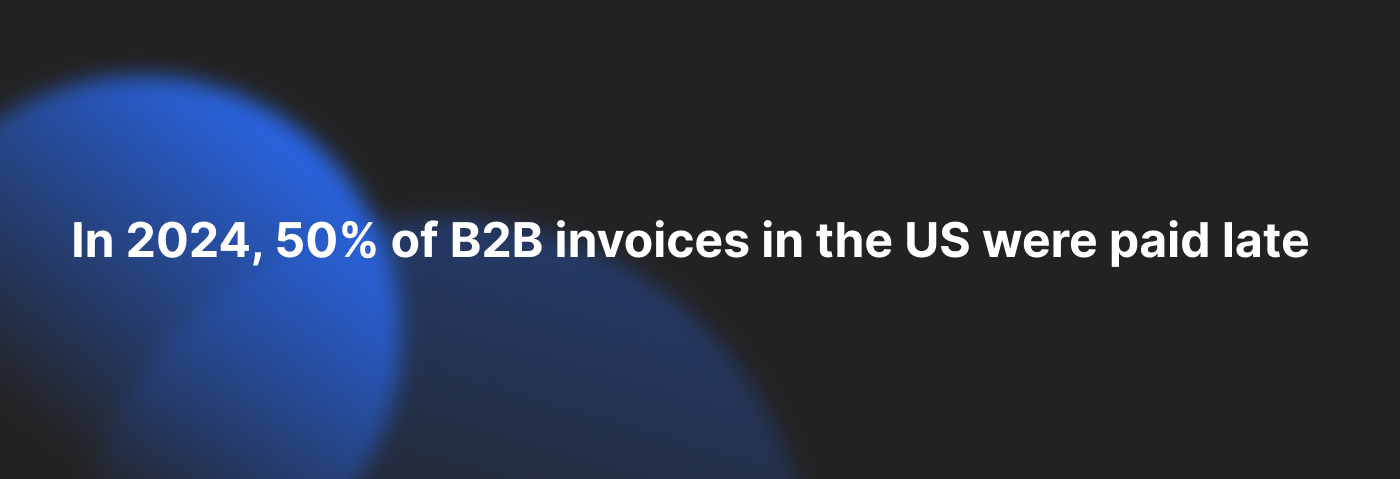

In 2024, 50% of B2B invoices in the US were paid late, underscoring the need for effective collections strategies.

This article delves into the world of commercial debt recovery, exploring how private collections agencies operate, their benefits, legal considerations, and more, tailored to businesses seeking to reclaim what they’re owed while maintaining a positive experience.

What Are Debt Collection Services?

Debt collection services are specialized offerings designed to assist businesses in recovering money from clients or partners who fail to pay on time. Unlike consumer debt efforts governed by strict regulations, commercial debt collection focuses on B2B transactions, think unpaid invoices for supplies, services, or contracts. A debt collection agency steps in when internal attempts, like reminder letters or phone calls, fall short, ensuring businesses can secure their money efficiently.

Imagine a construction firm waiting on payment for materials delivered to a contractor. Rather than diverting staff to chase the debt, they hire a collection agency to handle the process, preserving focus on ongoing projects.

Why Debt Collection Matters for Businesses

The scale of late payments is staggering. According to the Atradius Payment Practices Barometer 2024, 50% of B2B invoices were overdue, with an average delay of 20 days, and 8% of credit sales were written off as bad debts. These delays disrupt cash flow, forcing businesses to delay supplier payments, dip into reserves, or halt growth plans. Debt collection services address this by recovering funds that might otherwise be lost, offering a lifeline to companies of all sizes.

This is especially critical for industries like chemicals, where bad debts hit 8% due to frequent invoice disputes, highlighting the need for expert intervention.

How Private Collection Agencies Operate

Private collection agencies bring an external perspective, employing skilled debt collectors to manage the recovery process. They start by assessing the account, verifying the debt’s legitimacy with invoices and contracts.

Next, they contact the debtor through emails, phone calls, or formal notices, proposing payment options like installments or settlements. If initial efforts fail, they use advanced data tools to locate debtors, ensuring compliance with law and maintaining professionalism.

For example, a retailer owed money by a distributor might see the agency negotiate a structured repayment plan, securing funds without escalating tensions.

The Debt Collection Process Explained

The journey to recover past due accounts follows a clear path. It begins with verification, ensuring the debt is valid and documented. The agency then sends a notice to the debtor, outlining what they owe and offering a chance to pay. If there’s no response, follow-ups via phone calls or certified letters escalate the effort.

In stubborn cases, legal action may be considered, though the focus remains on resolution over confrontation.

This structured approach ensures transparency, giving businesses confidence that their collections are handled with care and efficiency.

Benefits of Hiring a Debt Collector

Outsourcing to a debt collection agency offers multiple advantages. First, it saves time, as staff can focus on serving customers rather than chasing payments. Second, it boosts cash flow by recovering funds tied up in delinquent accounts. Third, agencies bring expertise in navigating laws and negotiating with debtors, reducing risks of disputes. Finally, it provides peace of mind, knowing professionals are managing the process with respect.

A small logistics company, for instance, might recover thousands from a late-paying client, reinvesting that money into fleet upgrades without lifting a finger internally.

Industry-Specific Challenges in Debt Recovery

Different sectors face unique hurdles in managing debt. In chemicals, Atradius 2024 notes 8% bad debts due to invoice disputes over quality or delivery. Steel and metals see delays from administrative inefficiencies, while electronics/ICT firms grapple with clients’ cashflow issues. A collection agency must tailor its approach, perhaps verifying delivery records for chemicals or offering extended terms for tech clients, ensuring effective recovery across these varied landscapes.

Understanding these nuances helps agencies deliver solutions that resonate with specific clients, thereby enhancing outcomes.

Small Businesses and Debt Collection

Small businesses, often lacking dedicated finance teams, feel the pain of unpaid invoices most acutely. A single late payment can delay payroll or supplier orders, threatening survival. Debt collection services level the playing field, providing affordable access to professional debt collectors. By outsourcing, a local supplier owed money by a retailer can recover funds without draining limited resources, maintaining operations and growth potential.

This accessibility makes these services a game-changer for smaller enterprises reliant on consistent cash flow.

Legal Frameworks Governing Debt Collection

While commercial debt collection isn’t bound by the Fair Debt Collection Practices Act (FDCPA) like consumer debt, ethical agencies still adhere to state laws and best practices.

Harassment, false claims, or unfair tactics are off-limits. A reputable debt collection agency ensures every notice, call, or action complies with regulations, protecting both the business and its reputation. For instance, they might avoid contacting debtors outside business hours, fostering a positive experience while staying lawful.

Businesses should confirm their agency’s compliance to avoid legal pitfalls.

Technology’s Impact on Debt Collection Services

Technology is reshaping how debt collection services operate. Artificial intelligence analyzes payment patterns, flagging risky accounts before they go overdue. Automation streamlines contact efforts, sending reminders via email or text, while online portals let debtors pay instantly. These tools cut recovery times and improve efficiency, benefiting both agencies and their clients. A tech-savvy agency might recover funds in weeks rather than months, a boon for cash-strapped firms.

This digital shift also enhances transparency, with real-time updates keeping businesses informed.

Global Perspectives on Commercial Debt Recovery

Debt collection varies worldwide. In Europe, strict GDPR rules limit debtor data use, while Asia’s relationship-driven markets prioritize negotiation over legal action. US agencies, however, blend direct approaches with compliance, reflecting a litigious culture. A collection agency working internationally must adapt, perhaps using local partners in Japan to respect customs or navigating EU privacy laws for a German client. This global lens adds complexity but also opportunity for businesses with overseas debtors.

Choosing the Right Debt Collection Agency

Selecting a private collection agency requires due diligence. Look for a company with industry experience, transparent fees, and a track record of success. Ask how they collect, their approach to consumers or businesses, and how they report progress. A construction firm might choose an agency familiar with contractor disputes, ensuring tailored solutions. Regular communication, say, weekly updates keeps you in the loop, making the partnership seamless.

Ensuring a Positive Experience for All

A skilled debt collector balances firmness with empathy, offering flexible payment plans to debtors facing cashflow woes. This approach not only recovers funds but also preserves relationships, creating a very positive experience. For example, a debtor struggling after a slow season might appreciate a three-month plan, paying off the debt without resentment. Respectful tactics boost success rates and reflect well on the hiring business.

Conclusion

For companies battling unpaid invoices, debt collection services provide a professional, efficient path to recovery. Partnering with a debt collection agency ensures businesses reclaim what they’re owed, stabilize finances, and focus on growth—all while adhering to ethical standards. From small firms to industry giants, these services turn financial setbacks into opportunities, proving themselves indispensable in today’s economy.

FAQ

How do debt collection agencies charge?

Most charge a contingency fee (e.g., 20-40% of recovered funds), though flat rates exist for smaller debts.

Can small businesses afford these services?

Yes, many agencies offer scalable pricing, making them accessible to smaller firms.

What if a debtor disputes the debt?

Agencies verify claims with documentation, resolving disputes fairly and legally.