Commercial Debts

Whether you operate an HVAC company, construction firm, or a growing financial startup, your business relies on timely payments from your clients. However, commercial debts can arise when other businesses fail to pay their invoices. Non-payment can result from the debtor's financial health, disputes over services rendered, or poor communication between parties.

Receiving payments on time is vital for maintaining a profitable business, and accumulating commercial debt can hinder this goal. That's where business debt collection attorneys prove invaluable.

What is Commercial Debt Collection?

Commercial debt collection refers to the process of recovering overdue payments owed by a business or individual linked to business activities. This typically involves a creditor’s in-house collection team or outsourced professionals like a commercial debt collection attorney or agency. Larger corporations often employ collection specialists, while smaller business owners may rely on outsourced debt collection agencies or attorneys.

How Do Commercial Collections Work?

The commercial debt collection process is intricate and involves various steps, but it consistently includes issuing demand letters and sending regular reminders to the debtor about their obligation to pay.

Commercial Collection Steps

Step 1: Demand Letter

Demand letters play an essential role in the debt collection process, as they signify the creditor's commitment to resolving the issue at hand. Such letters demonstrate the creditor's serious intentions and outline the details of unpaid services or goods. When a professional debt collection agency sends a demand letter, it tends to be regarded with greater seriousness by the debtor.

Step 2: Filing a Lawsuit

Should the debtor fail to respond, creditors have the option to commence legal action by submitting a lawsuit. Commercial creditors must provide supporting documentation, such as invoices and contracts, to substantiate the debt owed.

Step 3: Serving the Summons

Once the lawsuit is filed, the court issues a summons, which formally informs the debtor of the lawsuit and their obligation to respond. A process server or sheriff delivers this document.

Step 4: Debtor's Response

The debtor must acknowledge the summons by submitting a response within 20 to 30 days of its receipt. Should the debtor neglect to respond, the court has the authority to issue a default judgment that favors the creditor.

Step 5: Discovery

At this phase of the legal proceedings, it is mandatory for both parties to share evidence and relevant information with one another. The opposing party may have a duty to supply documents, respond to interrogatories (written inquiries that demand sworn answers), and take part in depositions (sworn interviews conducted under oath).

Step 6: Settlement or Trial

The creditor and debtor may engage in negotiations to reach a settlement. This settlement represents a consensus on certain facts of the case, such as the outstanding debts owed between the parties. Should they fail to agree, the next step in the litigation process will be a trial, during which the court will consider evidence presented by both sides.

Step 7: Judgment and Enforcement

Should the creditor succeed in the lawsuit, a formal judgment will be rendered. This judgment constitutes a legal finding that requires the debtor to repay the owed amount. Once the judgment is obtained, the creditor may pursue a range of enforcement actions to collect the debt. Legal remedies at the creditor's disposal include wage garnishment, where a designated percentage of the debtor's income is deducted to address the debt, bank account levies that enable the creditor to withdraw funds from the debtor's accounts, property liens that secure a claim against the debtor's property to guarantee payment, and the possibility of asset seizure to recover the owed funds.

What is a Commercial Debt Collector?

A commercial debt collector, whether a lawyer or agency, specializes in recovering unpaid business debts. They negotiate payment plans, contact debtors, and ensure that overdue accounts are settled, all while adhering to commercial debt collection laws and ethical standards.

Commercial Debt Collection Laws

Understanding the laws governing commercial debt collection is crucial for any business. Several states across the U.S. require commercial collection agencies to be licensed, and in some instances, bonding is also mandated to ensure extra safeguards. Businesses should also know when it’s appropriate to consult a commercial collections attorney.

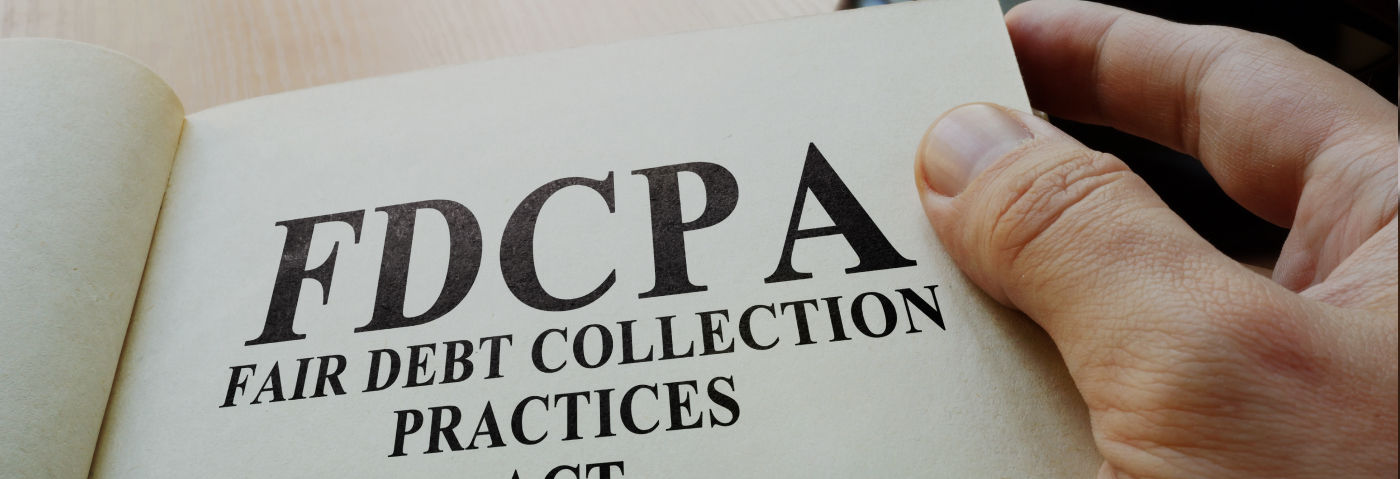

Does the FDCPA Apply to Commercial Collections?

In short, no. Contrary to common misconception, commercial collections are regulated by a separate set of guidelines distinct from those governing consumer collections. Specifically, the Fair Debt Collection Practices Act (FDCPA) does not cover B2B transactions or other commercial collection activities.

Unacceptable Methods in Commercial Debt Collection

Business owners should be vigilant about certain unethical practices that are strictly prohibited:

- Debt collectors are legally barred from using harassment or intimidation to secure payments. This includes any form of threatening behavior, excessive or abusive communication, or tactics that involve public humiliation or threats of physical harm.

- Additionally, debt collectors must avoid employing deceptive or unfair strategies when recovering business debts. This includes adding unauthorized fees not outlined in the original agreement, prematurely cashing post-dated checks, or presenting falsified documents designed to appear as official court orders or government communications.

- It is also illegal for debt collectors to misrepresent their identity, the amount of debt owed, or the legal standing of the debt. This includes falsely claiming to be attorneys or government officials, or providing inaccurate information regarding the debt’s balance or status.

How Much Does It Cost a Business to Send Someone to Collections?

There are two primary options for recovering commercial debts: hiring a debt collection agency or a law firm.

Hiring a Debt Collection Law Firm

Most commercial debt law firms charge either an hourly rate or a contingency fee, sometimes using a hybrid structure combining both methods.

Hiring a Debt Collection Agency

Debt collection agencies utilize a contingency-based payment structure, often described as "No Payment, No Fee." Under this arrangement, the agency is entitled to a fee solely after it has successfully collected past due receivables.

Debt collectors receive compensation solely upon the successful recovery of an outstanding debt. The fees associated with their services typically range from 25% to 45% of the total amount that is recovered.

Retrievables Debt Collection Services

With the Retrievables platform, commercial creditors can easily find qualified collections professionals with a proven track record. Our skilled team has assisted hundreds of businesses in resolving their debt collection challenges. By uploading your unpaid accounts to our platform, we help connect you with the most suitable attorneys or agencies for your specific commercial debt collection needs.