Managing accounts receivable effectively is crucial for companies regardless of their size. When clients delay payments, it can disrupt cash flow, curtail growth opportunities, and strain resources. This article delves into the significance of strong accounts receivable management and the role of collection agencies in safeguarding the financial well-being of businesses. It also emphasizes the advantages of partnering with Retrievables, a leading provider in accounts receivable management, to refine your business' collections approach.

Grasping the Essentials of Accounts Receivable Management

This operation entails the oversight, administration, and collection of payments that customers must make for the goods or services rendered. Proper management of these receivables is essential for ensuring the cash flow required for a company to meet its financial responsibilities and pursue growth prospects.

The Critical Role of Cash Flow in Business Operations

The significance of cash flow cannot be overstated for any organization. When payments are delayed or accounts remain overdue, cash flow can be severely impacted, resulting in challenges in meeting payroll, paying suppliers, or pursuing new opportunities. Organizations that emphasize effective receivables management are better positioned to ensure a stable cash flow.

Issues in the Management of Accounts Receivable

Businesses commonly struggle with issues like overdue accounts, complicated billing cycles, and constraints on resources. Many organizations find themselves without the necessary internal skills or capacity to address these problems effectively, which contributes to an increase in bad debt.

How Collection Agencies Assist Businesses

A collection agency focuses on the recovery of overdue accounts, assisting businesses in retrieving funds owed by their clients. These agencies provide various services designed to enhance the efficiency of the collections process:

- Dunning Letters and Calls: Collection agencies initiate a systematic approach to remind customers of their financial obligations through dunning letters and calls. These communications are strategically crafted to maintain professionalism while urging prompt payment. Automated reminders can be sent at various intervals, escalating in tone and urgency if necessary. This helps to maintain consistent follow-ups without putting a strain on internal resources.

- Claims and Balances Recovery: Agencies take proactive steps to address outstanding invoices by thoroughly reviewing claims and balances. They ensure that all overdue amounts are tracked and pursued in a timely manner, minimizing the chances of debts aging beyond recoverable periods. Whether through negotiation or legal means, the goal is to settle outstanding accounts while keeping business-client relationships intact.

- Debt Collection Practices: Collection agencies utilize a range of industry-compliant strategies to recover receivables. These practices may include formal demand letters, settlement negotiations, or even pursuing legal action when necessary. Each step taken is aligned with both local and national regulations, ensuring that ethical practices are consistently followed.

Utilizing a Collection Agency for Debt Recovery

- Time and Effort Savings: Agencies handle all the work related to collections, freeing up your team to focus on core operations.

- Increased Success Rates: Collection experts use proven strategies to recover owed balances efficiently.

- Improved Customer Relations: Professional agencies maintain respectful communications, preserving relationships with your clients.

Retrievables: Your Essential Resource in Accounts Receivable Management

Retrievables serves as a legal debt collection platform, connecting businesses with specialized attorneys who focus on recovering unpaid invoices in a timely and efficient manner.

The platform provides a wide range of services designed to help organizations manage their receivables effectively:

- Experienced Collections Attorneys: Retrievables provides businesses with access to a nationwide network of experienced collections attorneys, ensuring that each case is managed by experts skilled in the field of debt recovery.

- Legal Demand Letters: Retrievables assists in creating custom demand letters drafted by specialized attorneys, which can be a powerful tool in encouraging debtors to settle outstanding accounts.

- Enterprise Debt Collection: Connect with a Retrievables representative to discuss your collections needs, and they will assess your situation to determine the most appropriate collections law firm. Retrievables will then introduce you to the chosen firm, where you and the law firm will discuss the next steps and formalize the engagement.

Why Choose Retrievables?

Retrievables’ commitment to professionalism and results makes it a leader in the industry. Their collection experts are focused on delivering financial freedom for businesses by recovering overdue accounts and improving cash flow.

The Process of Collecting Payments

Retrievables employs a structured process to ensure success in collecting payments:

- Assessment: Determining the status of outstanding invoices and identifying overdue accounts.

- Strategy Development: Creating a plan to recover balances based on best practices and client needs.

- Execution: Initiating communications through dunning letters, calls, and other methods to collect payments.

- Monitoring: Maintaining transparent processes and providing updates to clients.

Ensuring Data Security in Receivable Management

Effective management of accounts receivable necessitates the protection of sensitive information to uphold trust and ensure compliance. Retrievables places a high priority on data security, leveraging cutting-edge technologies to defend both customer and business data against unauthorized access, breaches, and potential misuse. The organization employs comprehensive encryption strategies, secure storage facilities, and conducts routine security audits to ensure that all financial and personal information is treated with the utmost caution. Additionally, Retrievables keeps abreast of changing data protection laws and industry standards, giving clients peace of mind that their data is managed securely and in full compliance with legal requirements. This unwavering commitment to security not only protects business interests but also sustains customer trust throughout the receivables process.

The Role of Compliance

Adhering to industry regulations is crucial for ensuring ethical and legal practices in debt collection. Retrievables commits to following all applicable guidelines, which helps uphold its reputation for professionalism and trustworthiness.

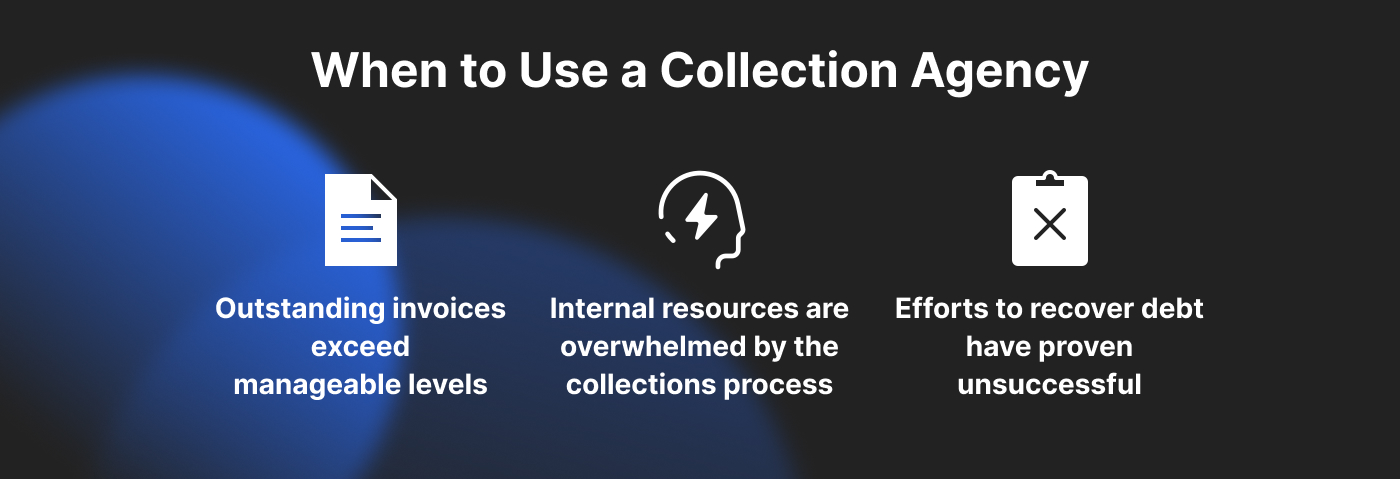

How to Determine When to Use a Collection Agency

Businesses should consider partnering with a collection agency when:

- Outstanding invoices exceed manageable levels.

- Internal resources are overwhelmed by the collections process.

- Efforts to recover debt have proven unsuccessful.

Examples of Industries Served by Collection Agencies

Collection agencies serve various industries, including:

- Retail

- Healthcare

- Professional services

- Manufacturing

Each sector benefits from tailored strategies to recover owed balances while maintaining customer relationships.

Discover the Financial Freedom of Professional Receivables Management

By partnering with a reputable collection agency, businesses can significantly improve their financial stability while alleviating the burden of managing overdue accounts. These agencies specialize in debt recovery, allowing businesses to offload time-consuming tasks such as chasing payments, handling customer inquiries, and negotiating settlements. With experts managing these aspects, organizations can reduce the strain on their internal resources and avoid the stress that often comes with pursuing unpaid invoices. Collection agencies are skilled in communication strategies and employ industry-compliant practices, which helps maintain professionalism and safeguard business relationships while ensuring timely payments. This enables businesses to focus their energy on core activities like growth, innovation, and customer acquisition, knowing that their financial health is being actively managed and improved. Ultimately, working with a trusted agency provides peace of mind, ensuring that cash flow remains steady and the focus remains on the long-term success of the business.

Small Businesses and Receivables

Small businesses, in particular, benefit from collection services. These companies often lack the resources to manage accounts receivable effectively, making professional assistance invaluable.

Large Enterprises and Accounts Receivable Management

For large enterprises, a collection agency ensures consistency and efficiency in handling high volumes of accounts. By outsourcing, they maintain cash flow and avoid resource bottlenecks.

Conclusion

The effective administration of accounts receivable is important for companies focused on preserving cash flow and achieving enduring success. Collaborating with a specialized accounts receivable management collection agency, which Retrievables can easily connect you with, ensures the successful recovery of overdue accounts while maintaining customer relationships and meeting compliance obligations.

Retrievables offers a no-cost consultation for businesses interested in refining their collection processes. Contact their team today to explore how they can help your organization achieve financial stability and growth. Don’t let overdue accounts impede your business—take proactive steps to recover what you are owed!