Debt collection has become cloud-first, analytics-heavy, and human-centered. Platforms now combine configurable workflows with machine-learning decisioning, omnichannel engagement, and embedded payments. Buyers expect end-to-end orchestration—from early delinquency to recoveries—with clear audit trails for regulations like FDCPA/Reg F in the U.S. and GDPR in the EU. For example, Reg F guidance limits contact at inconvenient times (generally before 8 a.m. or after 9 p.m., consumer’s local time), while GDPR raises the bar on data access, portability, and security—pushing vendors to bake compliance into product design.

Where Retrievables Fits for Commercial Teams

If you’re managing commercial (B2B) receivables, software alone isn’t always enough. Complex disputes, cross-border enforcement, or high-value claims often require specialized legal leverage. That’s where Retrievables shines:

- Matchmaking you can trust: Retrievables connects your claim to the most suitable commercial collections law firm or agency by jurisdiction and industry.

- No upfront platform fees: Businesses don’t pay Retrievables; network attorneys typically work on a contingency fee—a percentage of what’s actually recovered.

- Fast hand-off from your systems: Push unpaid invoices directly from QuickBooks Online or send past-due Clio Bills to kick off attorney demand quickly.

Think of Retrievables as your commercial escalation layer: keep AR automation and in-house collections running upstream; place hard cases to the right attorney or agency when stakes rise.

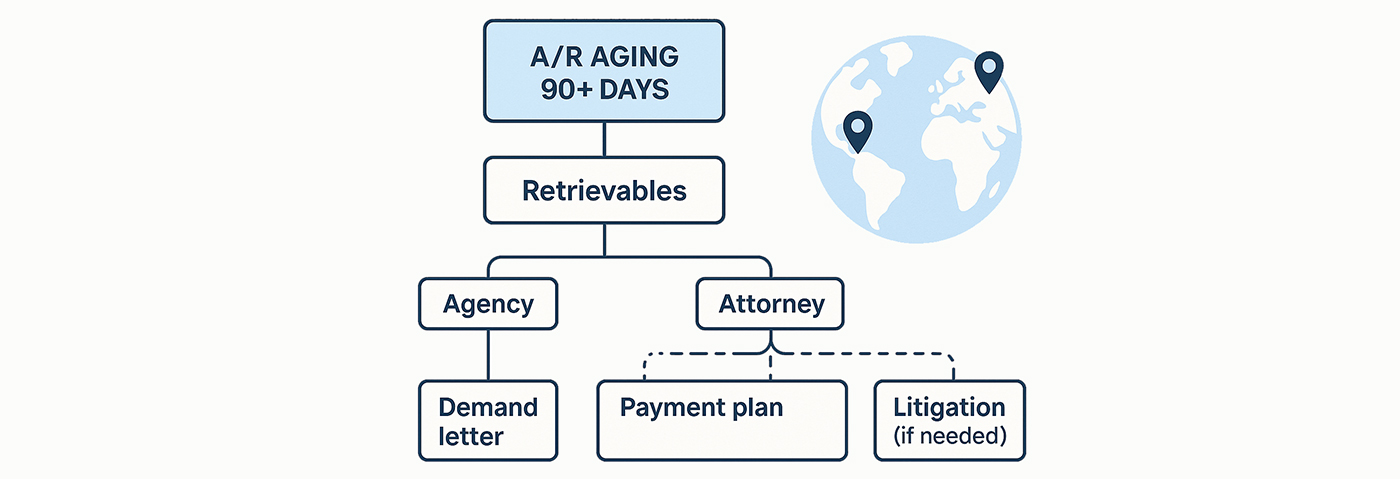

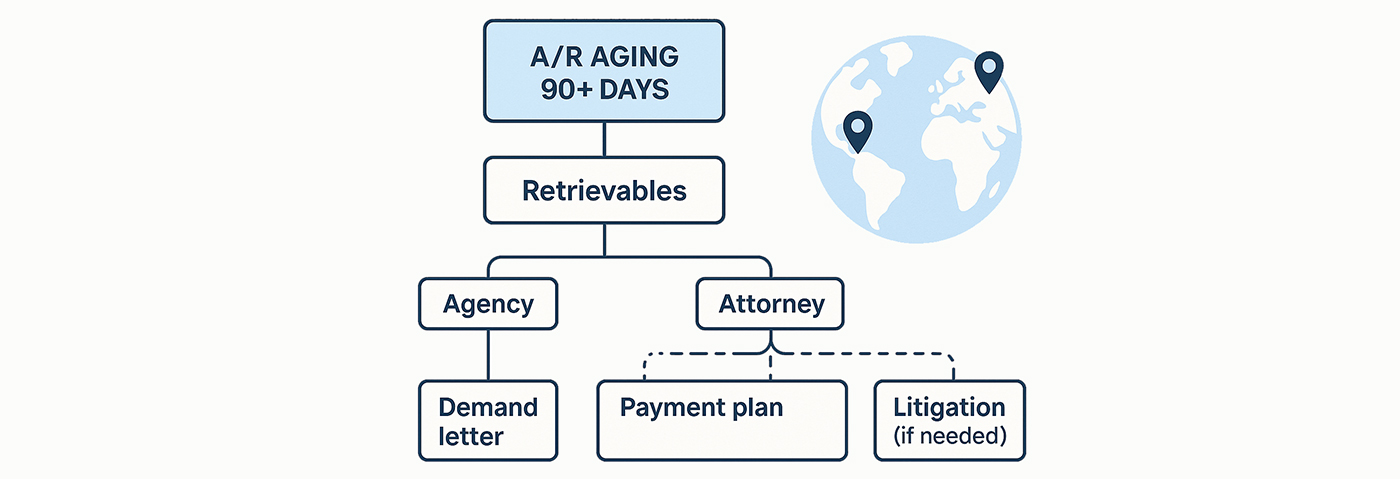

Attorney vs. Agency: Quick Decision Guide

- Use an agency when the debt is uncontested and persistent, professional follow-up is likely enough.

- Use an attorney when there’s a dispute, asset-hiding risk, cross-state enforcement needs, or you need demand letters with legal weight and potential filing.

With Retrievables, you don’t have to guess which route to take—describe the claim, jurisdiction, and documents; the marketplace recommends a fit and facilitates placement.

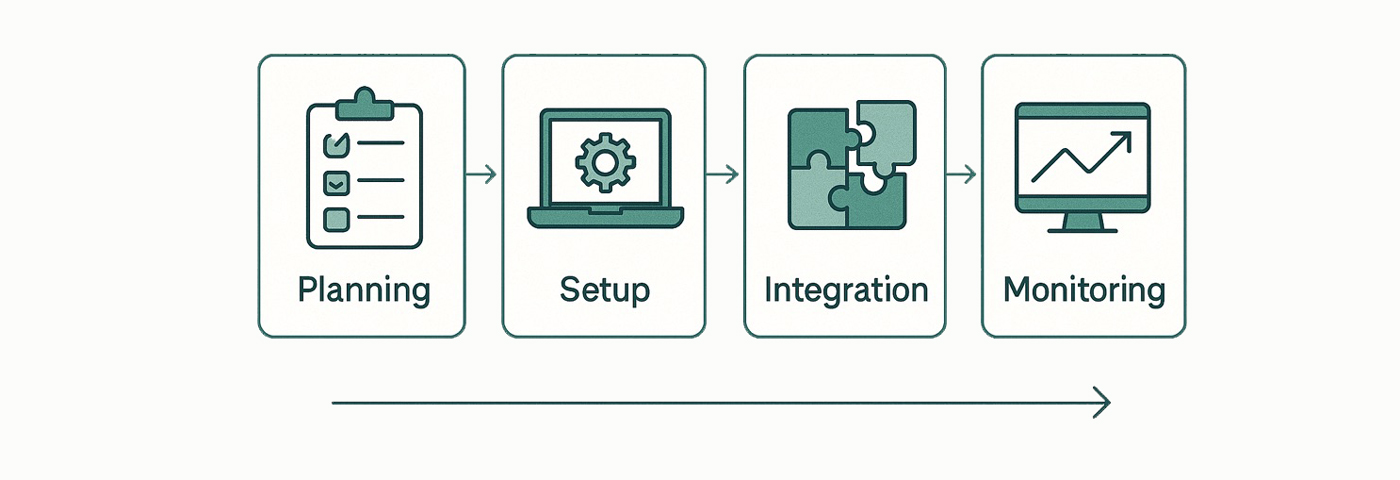

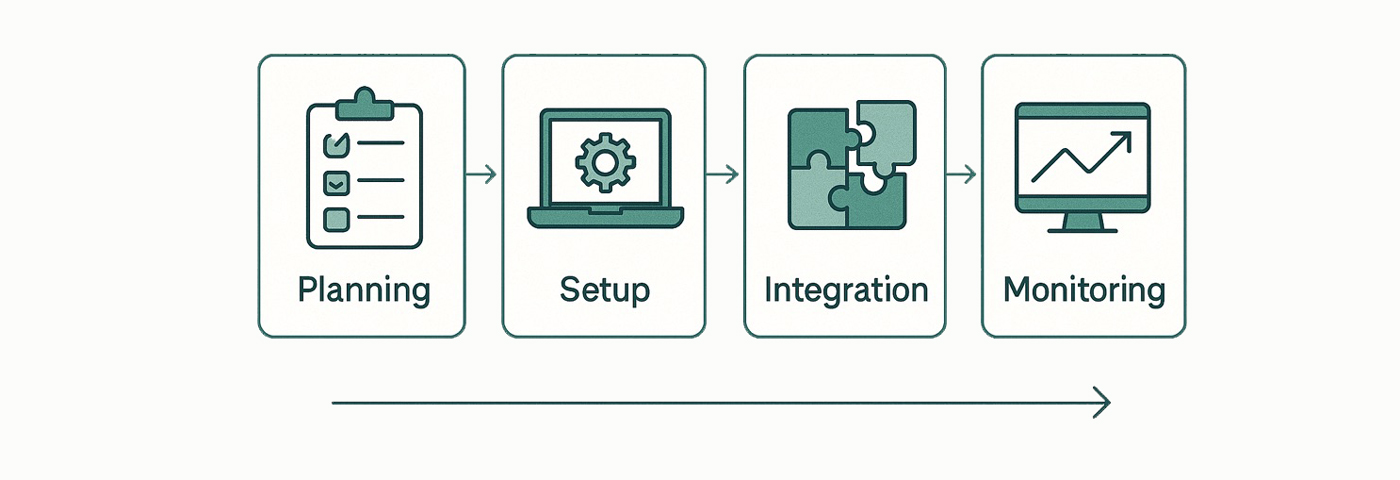

Implementation Playbook

- Design a pilot. Pick representative cohorts and baseline KPIs (DSO, cure rate, right-party contact, complaints).

- Integrate early. Connect ERP/CRM, payments, and data sources via APIs; verify event logs and audit trails.

- Turn on guardrails. Enforce contact caps, time-of-day rules, consent capture, and retention—map them to Reg F/FDCPA and local rules.

- Launch self-service. Set up portals and “pay-by-link” at go-live—these compounding wins reduce agent load.

- Iterate monthly. A/B strategies by segment; roll out what works.

Budgeting & ROI: What to Expect

- Licensing: SaaS by seats, accounts, or portfolio size; some charge by modules (outreach, analytics, payments).

- Payments economics: Embedded processors can reduce friction and speed reconciliation; test with a subset first.

- Time-to-value: Modern cloud suites and digital providers aim for weeks to a few months—pilot first to validate lift.

- Escalation costs: With Retrievables, attorney fees are typically contingency-based—align placement criteria to expected recovery value.

Mini-Scenarios: Fast Picks by Use Case

- Global retail bank (multi-product): C&R Software Debt Manager or CGI CACS X for end-to-end orchestration; QUALCO for multi-entity operations.

- Third-party agency scaling fast: Finvi Artiva RM or Velosidy; evaluate Aktos for AI guardrails and speed-to-value.

- B2B SaaS with late payers (first-party): Upflow or Gaviti to cut DSO; escalate stubborn accounts via Retrievables for attorney demand.

- Consumer fintech prioritizing friendly CX: TrueAccord or InDebted for digital-first journeys.

- UK/EU lender modernizing: Flexys with open-banking integrations to design fair, affordable paths.

FAQs

1) What’s the difference between AR automation and debt collection software?

AR automation (e.g., Gaviti, Upflow, Chaser) focuses on first-party invoice chasing, reminders, and payments to reduce DSO. Debt collection platforms (e.g., Debt Manager, CACS X, Retrievables) orchestrate collections and recoveries, segment risk, and handle legal paths post-charge-off. Many teams use both: AR upstream, collections downstream.

3) What compliance features should I insist on?

Ask for contact-time controls aligned to Reg F/FDCPA (e.g., no communication before 8 a.m. or after 9 p.m. consumer-local), consent tracking, opt-out management, robust audit trails, and data-subject workflows for GDPR (access, deletion, portability).

4) Do digital-first models actually improve outcomes?

Vendors like TrueAccord and InDebted demonstrate ML-driven outreach and self-serve tools that can raise engagement versus dial-heavy models. Validate vendor claims with a controlled pilot in your portfolio.

5) We operate in multiple countries—what should we prioritize?

Favor platforms with multi-region compliance, flexible data residency, and multi-language templates. Ensure your vendor supports regional rules (e.g., GDPR) and can manage consent and retention per locale.

6) How do contingency fees work with collection attorneys?

In contingency arrangements, you generally pay only if there’s a recovery; the attorney takes a pre-agreed percentage of amounts collected. This aligns incentives and reduces upfront risk. (Always confirm specific terms.)

Conclusion

There’s no one-size-fits-all answer. The winning choice blends automation, analytics, and compliance by design with a stack that matches your portfolio and regions. Use AR automation (Gaviti, Upflow, Chaser) to keep cash moving; deploy modern collections suites (Debt Manager, CACS X, Finvi, Telrock, QUALCO, EXUS, Flexys) for scalable, auditable recoveries. And when accounts become complex, Retrievables helps you find the most suitable commercial collection attorney or agency—so you escalate the right claims, at the right time, and improve net recoveries without piling on fixed costs.