Anyone who runs a business is bound to come across the problem of outstanding debts, primarily when clients or customers delay their payments beyond the due date of collection.

Late payment of debts is one of the major reasons why businesses suffer with cash flow problems, which then forces a business to take on debt, and the vicious cycle of never ending debts and chasing your own debtors begins.

This vicious cycle has ended more small businesses than we can count and it has ruined the growth plans for a lot of larger businesses.

So is there any way to solve the problem of unpaid debts, particularly commercial debts that can be the lifeblood of an organization? Yes, there is and it is called commercial debt collection.

What is Commercial Debt Collection?

If we look at debt in simple terms, there are two types of debts. Consumer debt and commercial debt.

Consumer Debt

This is debt that is owed by a person to a business. For instance a bank loans out a sum to an individual.

Fair Debt Collection Practices Act (FDCPA)

The Fair Debt Collection Practices Act (FDCPA) is linked with consumer debt and commercial debt is not within the ambit of FDCPA.

Commercial Debt

This is a debt that is owed by one business to another business. For instance a bank loans out a sum to a small business, or a large business. The size of the business does not matter here as long as it is a business.

So commercial debt collection refers to the recovery of money that is owed by one business to another.

The need for commercial debt collection arises in a situation where a supplier delivers goods but doesn’t get paid, or a service provider invoices a client who then does not pay.

In these situations, one business has fulfilled its obligation to provide service or deliver goods but the other business is not reciprocating it by paying the consideration within the due time.

The business that has provided the goods or service is expecting to receive payment within its cash collection cycle and if that payment is not received or delayed beyond reasonable time, then that business is going to experience cash flow problems.

Cash flow problems are the first issue that can snowball into liquidity problems if not managed in a timely manner. This is why it is so important to collect debts on time, so that the business can function properly without any cash flow problems.

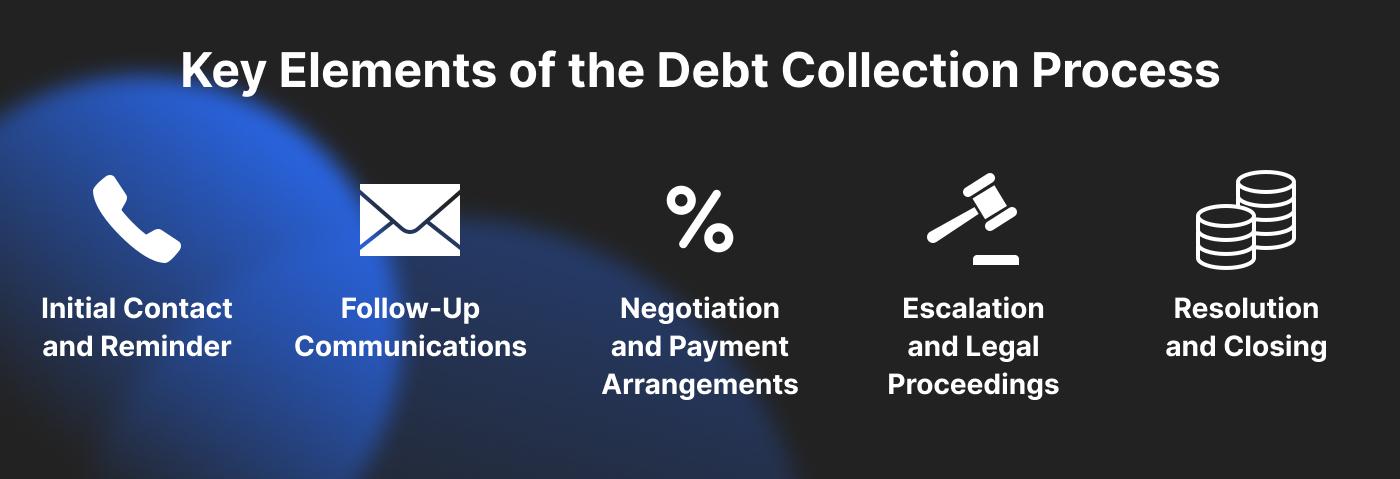

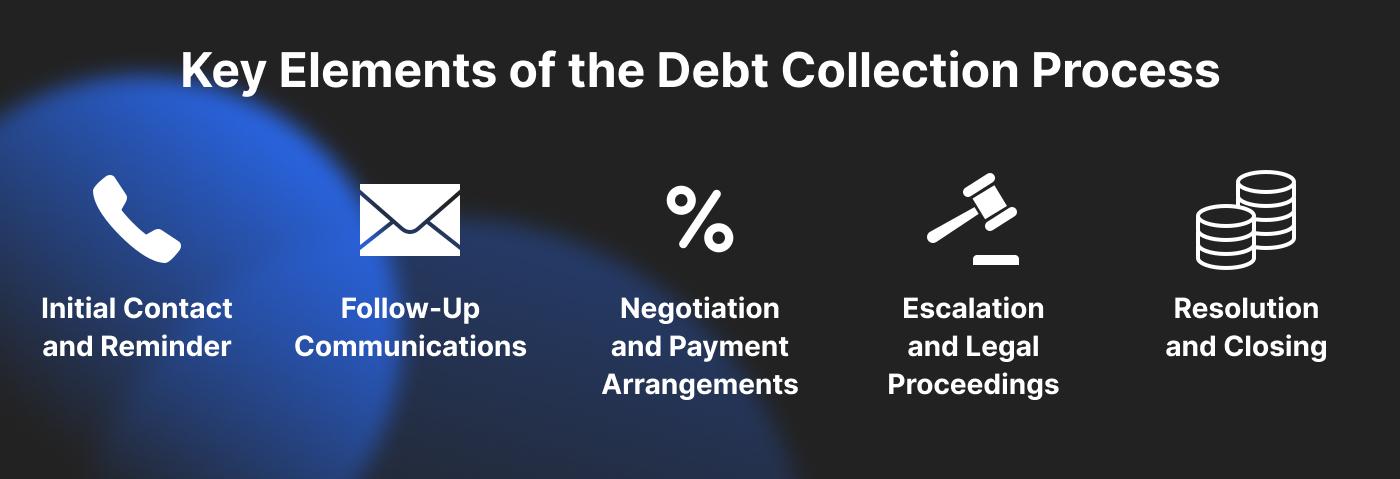

Step by Step Working of the Commercial Debt Collection Process

Let's go over the steps quickly and then we will discuss them in detail.

- Confirm that the payment has become overdue

- Client or customer is marked or flagged for collection

- Send out a reminder through the usual methods of communication.

- Send out a follow up the reminder

- Escalate the situation by sending a formal demand letter or onboarding a collection agency

- Initiate legal action

1. Confirm That the Payment Has Become Overdue

The first step is to confirm the amount and total volume of outstanding debts owed. Businesses usually keep an aged list of debtors, that segments the money owed by days. Once a payment becomes overdue, flag that debtor to be contacted.

2. Client or customer is marked or flagged for collection

Once the debtor has been marked, it is time to overview history with that debtor. Old clients, with whom a business has had a good working relationship should be approached in a different manner as compared to new clients or relatively new clients with a history of late payments.

It is also important to consider future prospects with a client. If a debtor/customer is a big purchaser, then they will be approached differently compared to a debtor/customer who is not contributing much towards repeat revenue generation.

How to Request Payment Without Ruining Business Relationships

Asking for money can feel awkward, especially with long-term clients. The simplest way to go about this is to have clear and defined credit terms upfront in the forms of a contract. Make sure everything is clear and that the client has understood the payment terms properly.

In addition to this, a friendly tone helps too. For instance:

“Hey, just a heads-up, this invoice is overdue—can we sort it out?”

Maintaining Good Relations During Collections

Chasing money doesn’t mean torching ties. Keep it respectful—firm but fair. A debtor today could be a loyal customer tomorrow if you handle it right.

3. Send out a reminder through the usual methods of communication.

Once the debtor/client status has been reviewed, initiate the debt recovery process by sending out a gentle reminder through the usual methods of communication such as a phone call, email and message.

4. Follow Up the Reminder

If the debtor responds to the first reminder and agrees to pay, it is a win win. Sometimes debtors may ask for concessions and an increase in the payment period. It is always good to give some room to the debtors, to retain them as future customers and generate some goodwill in the process. There is no need to strong arm a debtor who is willing to pay in a slightly longer payment period.

If the debtor has not responded, then the follow up reminder can be structured in a slightly more formal tone, with your future steps outlined. At this point, it is important to let the debtors know that refusal to pay will lead to legal consequences.

Offer a Payment Plan

The best thing about commercial debt collection is that the debtor is also a business and the last thing that a business needs is for their image to be tarnished as a result of bad debt. Which is why in many cases, the debtors would be more than willing to pay if offered an olive branch in the form of a payment plan.

Once the debtor's financial situation is established and it is determined that they cannot pay on time but are still willing to pay, then the business can offer a revised payment plan that best suits the debtor. This creates goodwill and keeps the client relationship intact as well.

Late Payment Penalties

Adding late payment penalties to contracts is a simple way to avoid late payments. These penalties act as an incentive to pay on time.

If a client knows they’ll owe extra after the due date, they’re more likely to prioritize the invoice. It’s a simple way to avoid non-payment headaches and increase the chances of collecting debt.

5. Escalate the situation by sending a formal demand letter or onboarding a collection agency

If the debtor shows no sign of paying back, then escalate by sending a formal demand letter or hiring the services of an agency to collect commercial debts.

What is a Letter of Demand?

A demand letter is a formal letter requesting payment sent to a commercial debtor. It outlines the amount due in total, the date by which it is expected to be repaid, and the future steps that the creditor/business intends to take.

This letter is necessary if the business intends to take legal action. It is an admissible document that establishes the fact that the business/creditor tried in good faith to recover the debt, before escalating the matter to more “aggressive” means of debt collection.

6. Contact a debt collection agency or Initiate legal action

If the debtor has not responded to the demand letter, the business has two options. Take legal action to recover the debt or engage the services of a commercial debt collection agency.

When to take legal action?

If the debtor has not responded or repeatedly refused to pay back, then legal action becomes the last resort. The disadvantage of going to court is that it takes up a lot of time and resources. This disadvantage can be outweighed only if the owed money is significant enough to warrant the time and resources.

However if the outstanding amount is related to multiple debtors, then a business can consider getting the services of a commercial debt collecting agency.

What is a Commercial Debt Collection Agency?

A commercial debt collector or a commercial debt collection agency is an agency that specialises in recovering commercial debts. Since these agencies specialise in recovering owed money, they have the experience, time, and the resources to recover debts that a business may not have.

What Sets Debt Collectors Apart?

Commercial debt collectors specialise in recovering commercial debt. Since they have more experience, time and resources than businesses who actually need the money recovered, they can perform this task more efficiently.

Furthermore, these agencies know the intricacies of business to business relationships, which is why they take care not to spoil the business and client relationship.

When Do You Need Debt Collection Services?

Debt collection services factor in when the business is juggling too many past due accounts and legal action is not on the table.

What Are Collection Costs?

Hiring a collection agency isn’t free. Collection costs vary—some charge a flat fee, others take a percentage of what they recover.

Businesses need to determine if the cost of hiring a collection agency is worth it or not. If the debts are too small, it is better to write them off as bad debts.

However, if the amount is worth recovering but not big enough to utilize the services of a legal attorney, then a commercial debt collection agency becomes a viable option.

Tools Used by Debt Collection Agencies

Commercial collection agencies have a number of tools at their disposal. They use software to track overdue payments, templates for demand letters, and most importantly teams with extensive experience negotiating with debtors.

Choosing the Right Agency

Here is a quick checklist to help businesses choose the right commercial debt collection agency:

- Set your budget and expectations for recovery

- Short list agencies with good reviews that fall within your criteria

- Look for agencies with a good track record of debt collection

- Look for success and recovery rates

1. Set your budget and expectations for recovery

Clearly define your budget and your expectations from the debt collection agency, so that there is no confusion later on.

Collection agencies have a number of payment terms. For instance some agencies offer flat rates, while others price their services based on recovered amount. Some agencies also charge a flat rate and some additional percentage of the recovered amount.

2. Short list agencies with good reviews that fall within your criteria

A simple search can pull up agencies that match your criteria. Look for positive reviews and testimonials. Search social media and all relevant forums.

Make sure that the agency you are looking for has experience in handling the type of debts that you want recovered.

Most importantly, make sure that the agency you are interested in hiring is compliant with all state and federal laws that are applicable.

3. Look for agencies with a good track record of debt collection

Once you have shortlisted the agencies, contact them and ask them to share their track record, average recovery time and success rate. You can also ask for a list of their past clients and reach out to the clients for testimonials.

Below are a few more points to consider:

Transparency

Make sure that the agency you want to hire is transparent in reporting the progress.

Tech Stack

Make sure that the agency you use has an updated tech stack. Its operations must be streamlined with relevant technology.

Fee structure

Review the fee structure and terms of the contract before signing anything. Make sure that there are no hidden charges or any fine prints to the contract.

What Pressure Tactics Do Debt Collectors Use?

Collection agencies know how to push without crossing the line. They might call more often, send certified letters, or hint at legal options. It’s all psychology—making the debtor feel pressure until they pay what’s owed.

Global Practices

Debt collection practices vary by country. Most countries have stringent rules on commercial debt collection agencies while others have more lenient rules that allow debt collectors to use strong handed techniques. In the U.S there is a mix of both stringent and lenient practices.

How Do State Laws Affect Commercial Collections?

State laws shape how far you can go with commercial collections. Some states cap fees or require licenses for collection agencies.

The Time Factor in Recovering Debts

Recovering debts isn’t quick. From first call to final payment, it’s often weeks or months. The time involved is why many businesses lean on debt recovery agencies for bigger cases.

Debt Collection Services and Small Businesses

Small businesses lean on debt collection services to level the playing field. Without a big finance team, chasing past due accounts solo is often not feasible.

Final Thoughts

Mastering business debt collection is about balance—knowing when to push, when to negotiate, and when to call in help. Whether you’re handling it in-house or hiring a commercial debt collection agency, the goal is the same: get paid without losing sleep.