Marketplace platform - make connections quickly

Gain new clients at a low acquisition cost

Why Retrievables

Legal collections - the most effective solution

Matching businesses with the most suitable attorneys

How it works

$5,850,000

Amount of debt received

FAQ

Businesses collect money in multiple ways; through internal processes, collections agencies and collections law firms. When collecting debt internally or through a collection agency, businesses can use only phone, letters or electronic communications.

Collections attorneys concentrate their practices in debt collection. They have the capacity to collect by filing lawsuits and using the power of the courts to enforce payment of unpaid debt.

Typically, collections attorneys operate on a contingency fee basis and are paid a percentage of what is collected once a payment is made. Court filing costs may be incurred.

Retrievables matches businesses to collections attorneys to pursue their cases. Collections law firms select their cases based on the location of the debtor, the amount of debt owed, the client’s industry and the amount of documentation provided.

Retrievables provides companies with the opportunity to work with attorneys who are most likely to succeed in collecting past due debt.

Retrievables marketplace platform provides a quick and easy way to connect to collections attorneys.

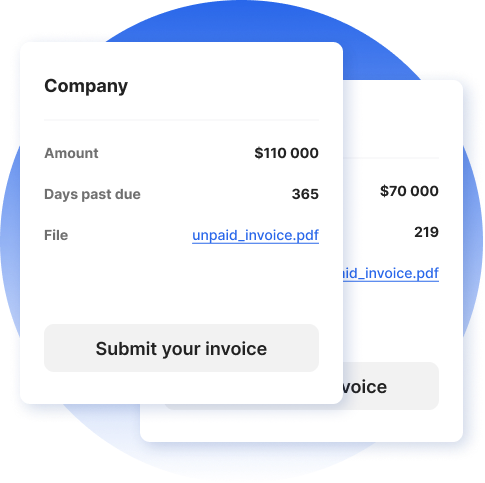

Businesses utilize the platform to provide information on the debt they are attempting to collect. The information is shared with the Retrievables network of attorneys to review the cases in order to determine if it is a fit for their firm.

When an attorney accepts a case, Retrievables connects the company and the law firm on the platform and via email. Then they have the opportunity to discuss the case and may sign a retainer agreement and work together to resolve the debt.

Retrievables requests the information needed on each case. The more information and documentation there is on a case, the better chance that the attorney will achieve success in collecting the debt.

Retrievables collects the following information for each case:

- Debtor name

- Debtor location

- Amount due

- Days past due

- Brief summary of the case

- Documentation which may include contracts, invoices, correspondence, credit card receipts, copy of a check and any other information which may be necessary based on the uniqueness of the case.