Importance of Enterprise Recovery for Large-Scale Businesses

For enterprises, debt recovery isn’t just about retrieving outstanding payments—it’s about protecting their bottom line. Enterprises often deal with larger clients, so the amounts of outstanding debts can be significant. Failure to recover these payments can lead to cash flow issues, which might hamper business operations. Moreover, effective enterprise recovery helps preserve valuable business relationships by resolving issues diplomatically and professionally.

Understanding Enterprise Debt Collection

Who is an Enterprise Debt Collector?

An enterprise debt collector is a professional or firm that specializes in recovering outstanding debts for large-scale businesses. These collectors work with enterprises that have more complex and higher-value accounts, requiring specialized expertise and resources that go beyond traditional debt collection practices.

Enterprise debt collectors often handle substantial sums of money and must navigate complex contractual agreements. Their role involves engaging with legal teams, managing large volumes of data, and utilizing advanced software to track outstanding payments and collections processes.

Differences Between Regular and Enterprise Debt Collection

The primary difference between regular and enterprise debt collection lies in the scale and complexity. While regular debt collection may involve smaller amounts and a straightforward recovery process, enterprise debt collection deals with large sums of money, multiple stakeholders, and intricate financial contracts. Enterprise collectors also often work within a more strict legal framework to ensure compliance with corporate regulations.

Enterprise Services Collections

Key Components of Enterprise Services Collections

Enterprise services collections involve several critical steps that are integral to successful debt recovery. These steps include:

- Identifying Delinquent Accounts: Tracking overdue payments and determining which accounts require intervention.

- Communication Strategies: Crafting professional and effective communication to recover debts while maintaining positive business relationships.

- Legal Action if Necessary: Engaging legal teams to pursue debts through the court system if initial collection efforts are unsuccessful.

- Reporting and Analytics: Providing detailed reporting on the collection process to assess performance and outcomes.

Best Practices in Managing Enterprise Collections

To optimize enterprise services collections, companies should adhere to best practices such as:

- Consistent Monitoring: Keeping track of outstanding invoices and addressing issues early before they escalate.

- Tailored Approaches: Developing specific collection strategies based on the client’s industry and payment history.

- Legal Compliance: Ensuring that all collection activities comply with national and international legal standards.

Challenges in Enterprise Recovery

Common Issues Faced During Enterprise Debt Recovery

Recovering debts in large enterprises is often fraught with challenges, including complex contracts, international regulations, and the need to maintain positive client relationships while pursuing aggressive collection strategies.

How Legal and Regulatory Compliance Impacts Collections

Enterprises must adhere to strict legal and regulatory requirements when recovering debts. Non-compliance can result in penalties, lawsuits, or reputational damage. Enterprise debt collectors must ensure that all actions taken align with corporate governance rules, industry-specific regulations, and international laws when applicable.

The Role of Technology in Enterprise Recovery

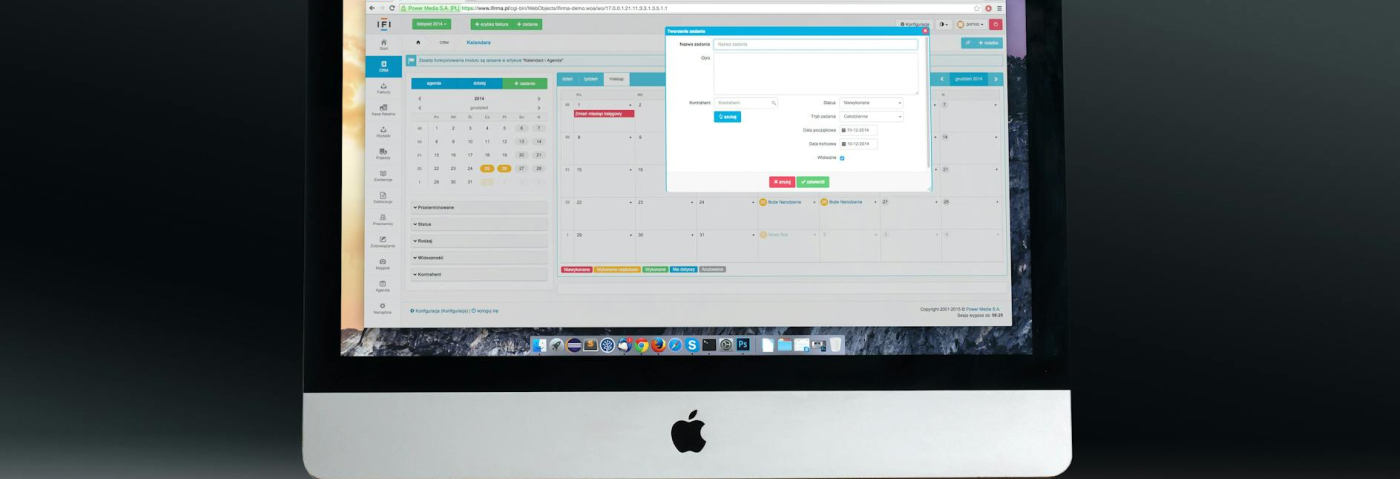

Leveraging Automation for Debt Collection

The use of automation in modern enterprise recovery strategies is vital. Automated technologies improve communication, provide reminders, track payments, and generate reports, all of which help to lessen the time and labor involved in the collections process.

Importance of Data and Analytics in Recovery

Data and analytics provide invaluable insights into the performance of enterprise debt recovery strategies. By analyzing patterns in payment behavior, enterprises can identify which accounts are likely to default and take proactive measures to mitigate losses.

Proven Methods for Efficient Enterprise Debt Collection

Tailored Approaches to Debt Recovery for Large Enterprises

Effective enterprise debt recovery requires a customized approach. This may involve setting up specialized teams, offering payment plans to delinquent clients, or utilizing external agencies to assist in difficult cases.

Maintaining Strong Client Relationships

Upholding a constructive relationship with clients is crucial throughout the debt recovery process. Effective communication and a readiness to engage in negotiations can facilitate this delicate balance.

Retrievables: A Game-Changer in Enterprise Debt Recovery

Retrievables is a cutting-edge debt collection marketplace that offers enterprises access to a vast network of collection attorneys and law firms. By leveraging the expertise of specialized professionals, Retrievables simplifies and accelerates the debt recovery process for large-scale businesses.

Benefits of Using the Retrievables Platform for Enterprise Debt Recovery

Retrievables connects enterprises with experienced attorneys and law firms that specialize in corporate debt recovery. This network of professionals ensures that collections are handled with the utmost precision and legal compliance, ultimately increasing the chances of a successful recovery. The service also provides transparency, allowing enterprises to monitor progress in real time.

Conclusion

Enterprise recovery is a crucial aspect of maintaining the financial health of large-scale businesses. With complex transactions and significant sums at stake, enterprises need specialized strategies and professional services to recover unpaid debts. By leveraging the right tools and working with experienced enterprise debt collectors or platforms like Retrievables, businesses can safeguard their cash flow, ensure compliance, and preserve client relationships.